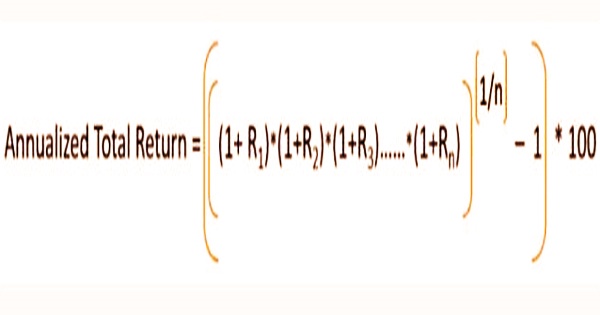

Annualized return formula

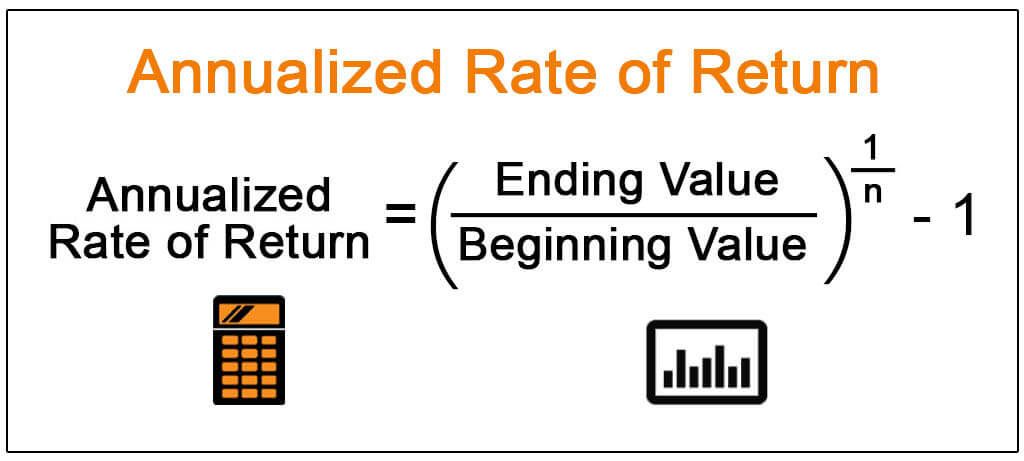

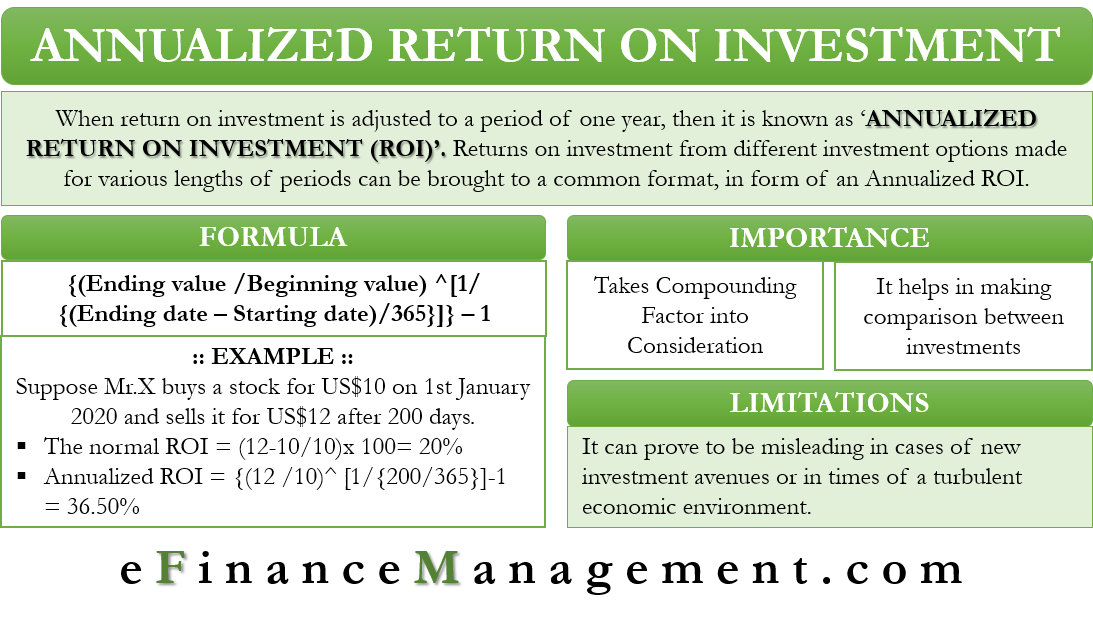

Here t number of years. It serves as a basis for comparison when the rate of return on short-term investments ie the ones made for less than a year are annualized.

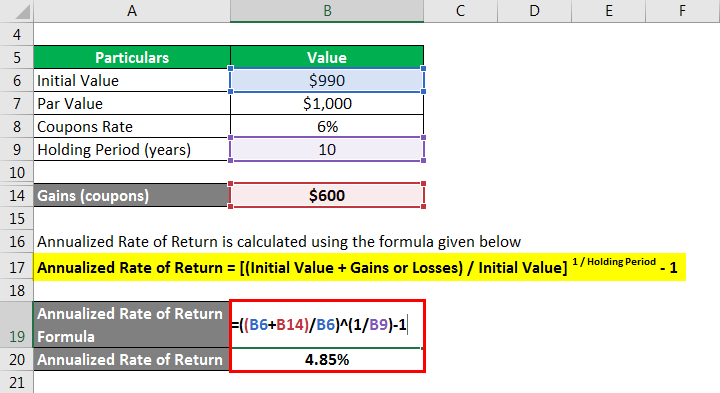

Annualized Rate Of Return Formula Calculator Example Excel Template

The Global Investment Performance Standards dictate.

. By using the annualized rate of return formula we are now able to compare the returns for both investments over the same time frame. Examples of Expected Return Formula With Excel Template Lets take an example to understand the calculation of the Expected Return formula in a better manner. Expected Return Formula Example 1.

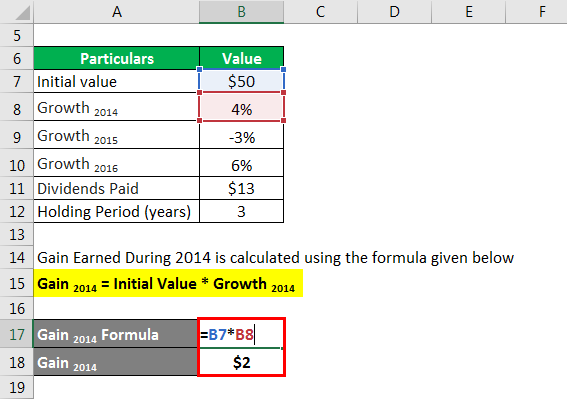

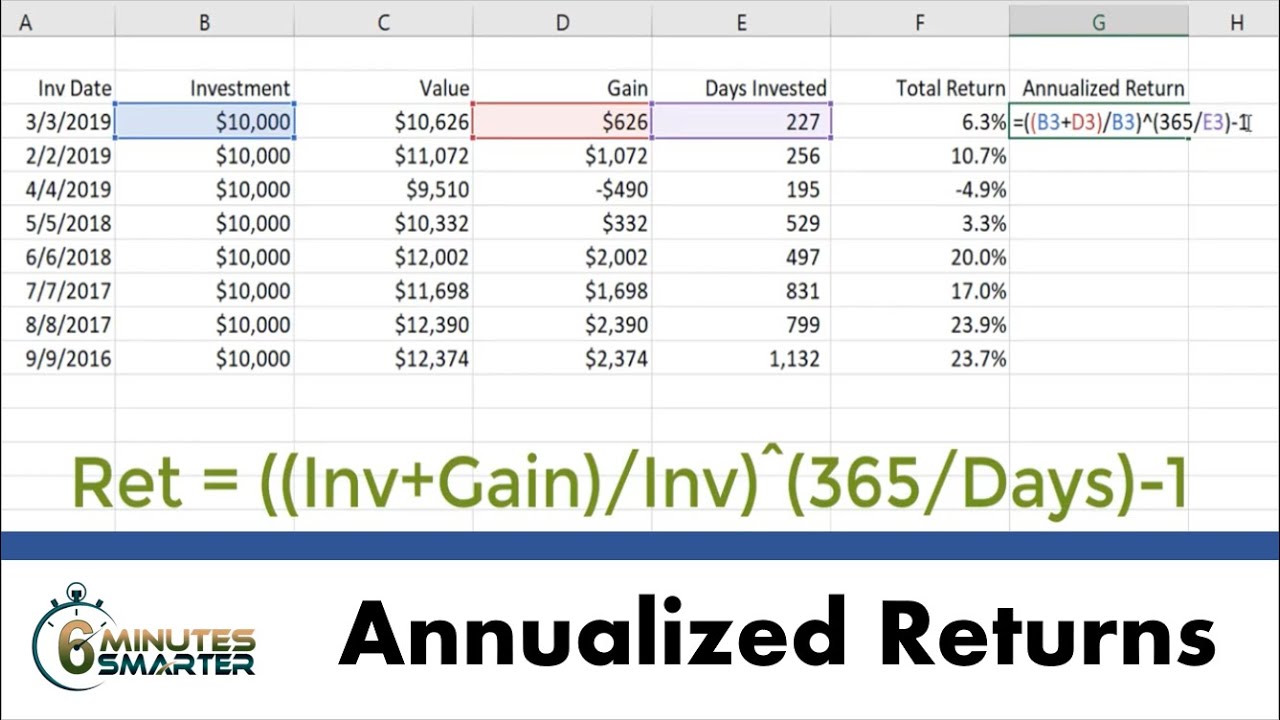

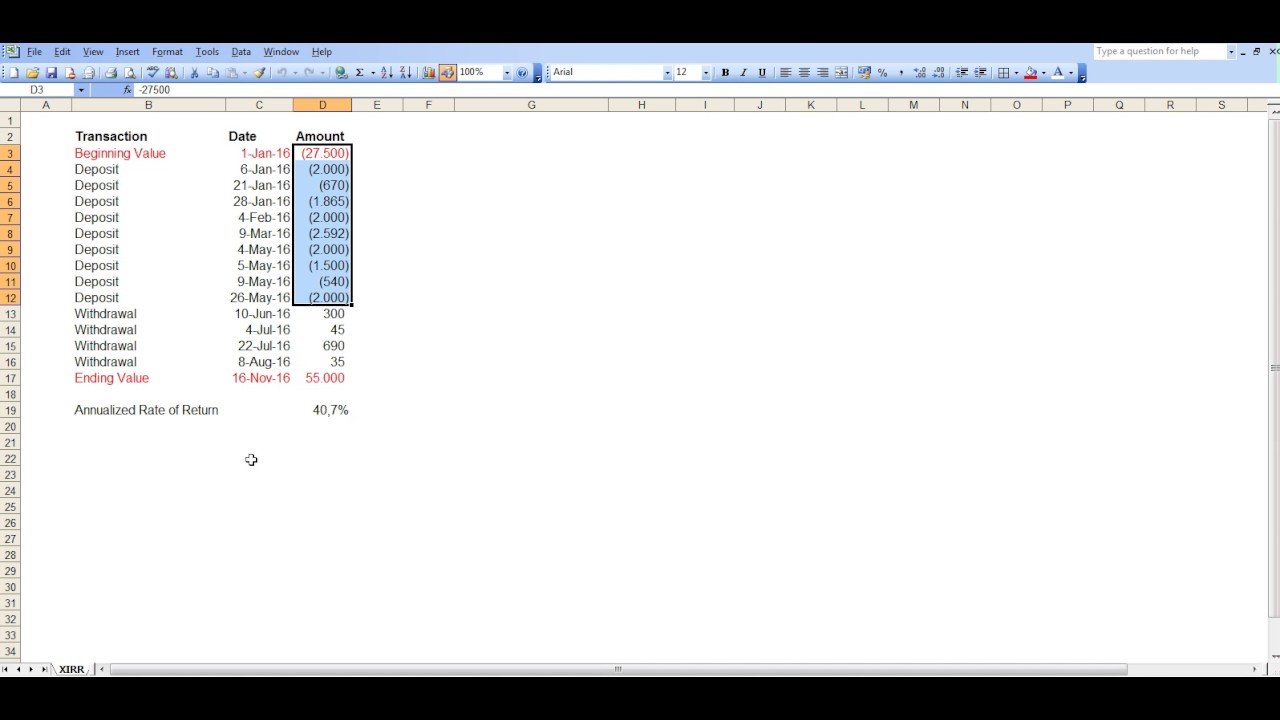

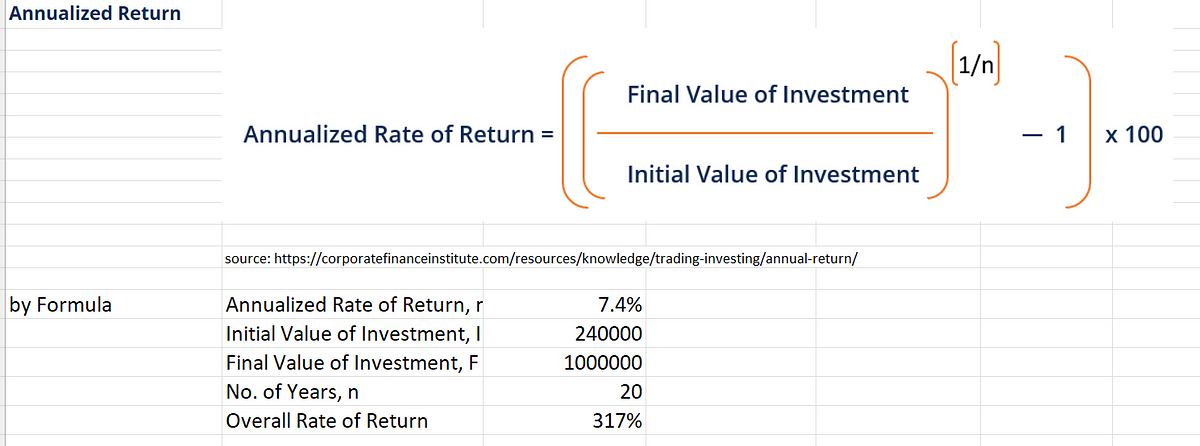

We will calculate the number of years by considering Investment Date deducted by Sold Date and divide the number of days by 365. It is one of the limitations of the traditional ROI formula but we can overcome this by using the annualized ROI formula. There are two options for calculating the annualized return depending on the available information.

In the annualized return formula the 1 that is divided by N in the exponent represents the unit that is being measured eg. Finally when an asset has no debt on it its seem like the ROE formula is the same as calculating your Cap Rate NOI market value. Dividend yield is represented as a percentage and can be calculated.

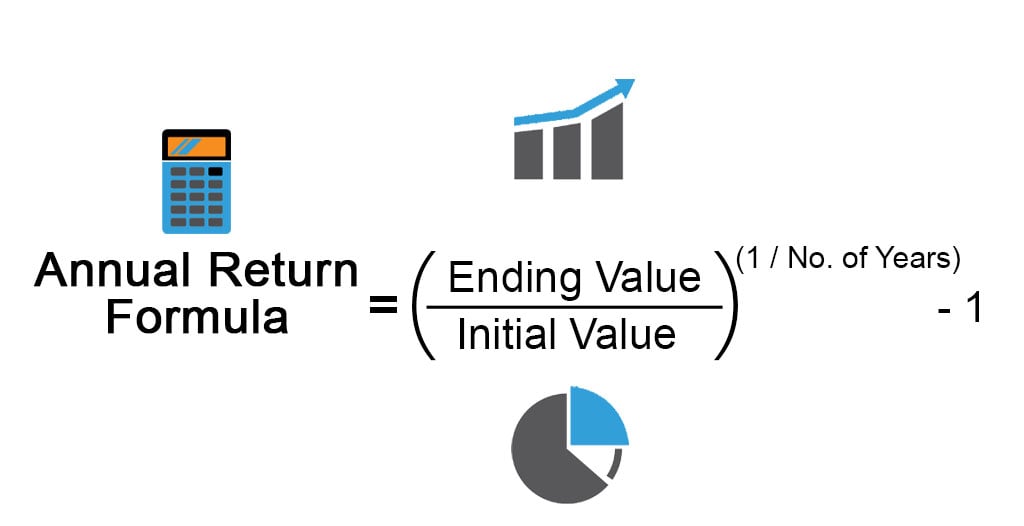

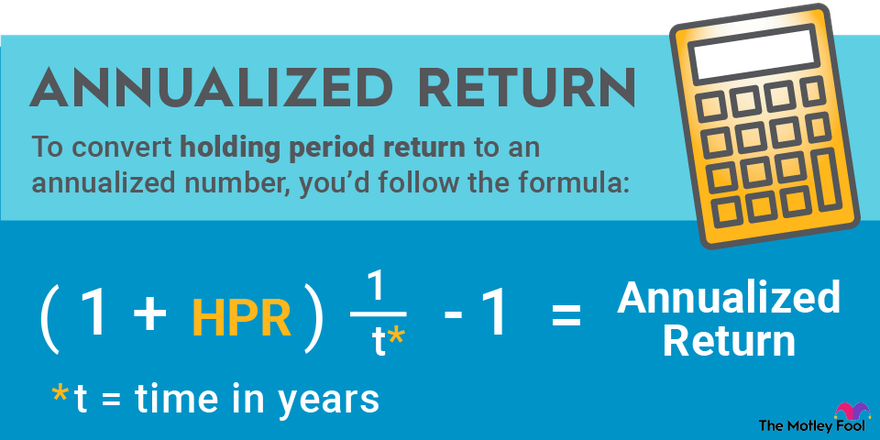

I look forward to your reply or hearing from you. The annualized return incorporates compounding. An annualized total return is the geometric average amount of money earned by an investment each year over a given time period.

Price to Earnings PE is one of the most popular ratios formulae that are being used by investors for valuing companies and taking investment decisions. Coverage Ratio Formula in Excel With Excel Template Here we will do the example of the Coverage Ratio formula. A financial ratio that indicates how much a company pays out in dividends each year relative to its share price.

Therefore we can conclude that the investment property in Miami provides the best return at an annualized rate of 321. Once you have the overall return you can then calculate the annualized return. It is an actual profit including taxes and fees.

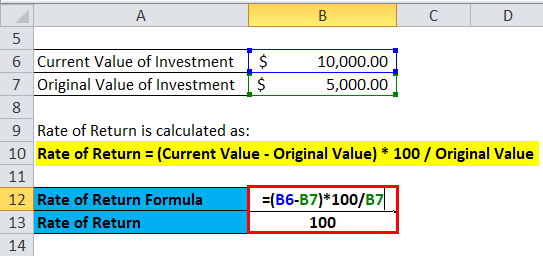

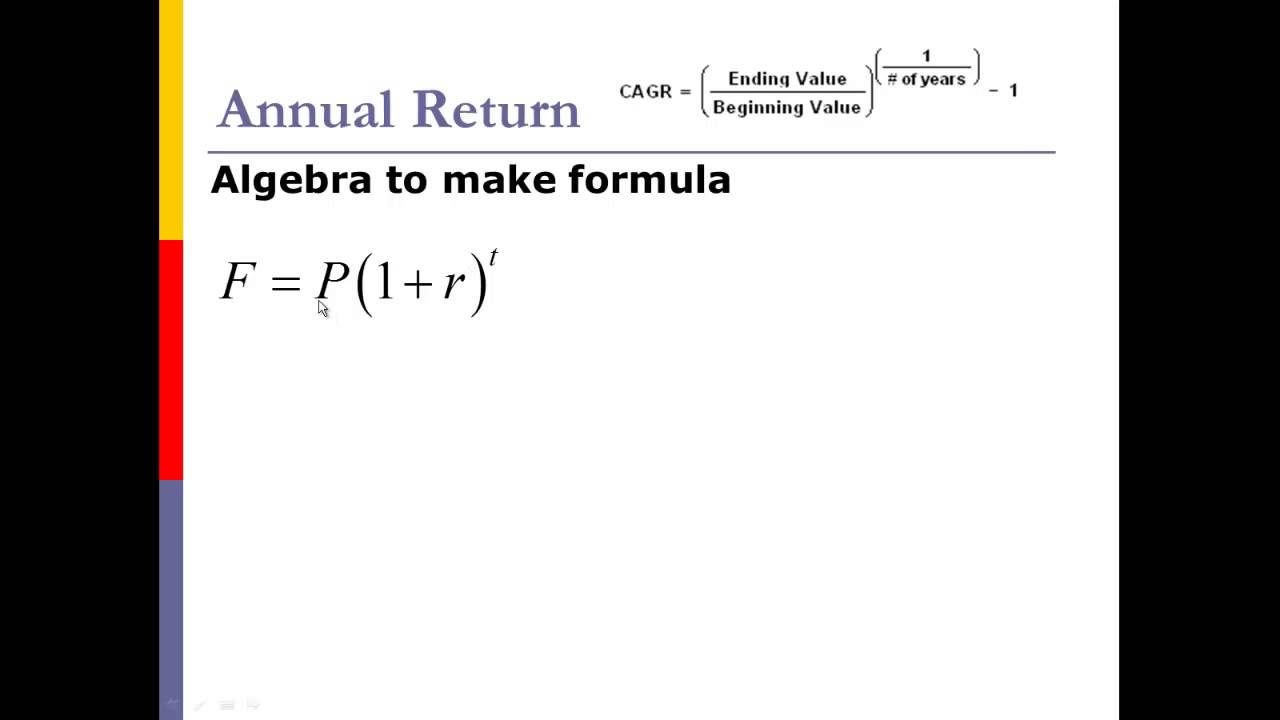

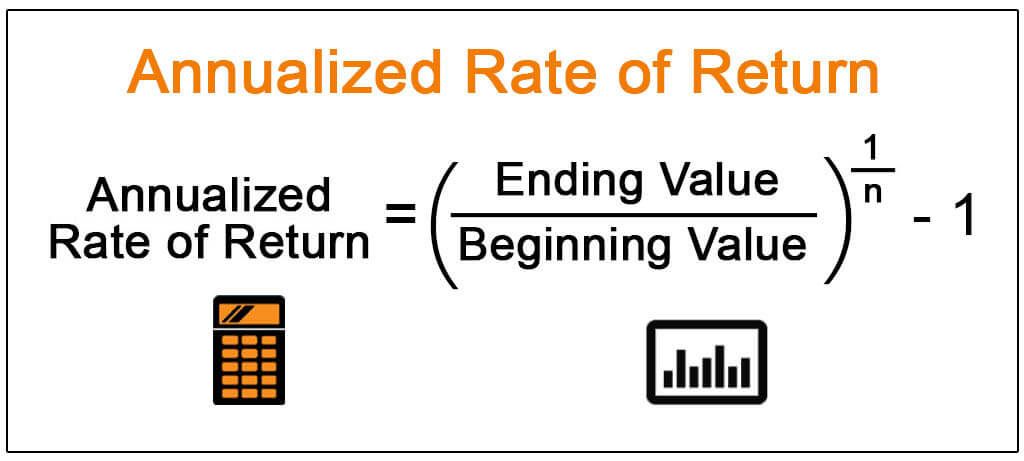

So we need to know 2 things. CAGR ending value beginning value 1 years held - 1 Using our example. The formula for return on sales can be derived by using the following steps.

Average annual rate of return. Thank you for reading CFIs guide on Annualized Rate of Return. When you are given the annual returns for each year of the investment period then.

Price to Earnings Ratio Market Price of Share Earnings per Share PE 165481191. The zero percent that you really got is the geometric mean also called the annualized return or the CAGR for Compound Annual Growth Rate. To calculate the correct annualized rate of return we have to use this formula.

Firstly figure out the initial investment value which is the investment at the beginning of the given period. In this example the 25 is the simple average or arithmetic mean. Closing price on 9302015.

Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one. An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period of time. Looking the data up on Yahoo.

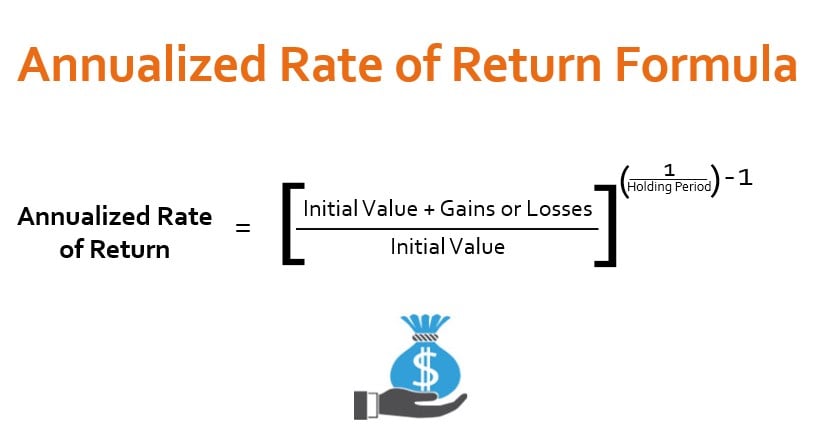

10481 1 r. Formula of Annualized Rate of Return Formula Of Annualized Rate Of Return The annualized rate of return is the percentage of return an investment provides yearly. Therefore it is also known as the Compound Annual Growth Rate CAGR.

Use this interest calculator offline with our all-in-one calculator app. An annualized rate of return is the return on an investment over a period other than one year such as a month or two years multiplied or divided to give a comparable one-year return. It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg.

Calculate Cash on Cash Return. The term money multiplier refers to the phenomenon of credit creation due to the fractional reserve banking system under which a bank is required to hold a certain amount of the deposits in its reserves in order to be able to meet any potential. ROI Formula Gain from Investment Cost of Investment 100 Cost of Investment Gain from investment refer to sales of investment interest Investment Interest Interest in investments is the periodic receipt of inflows on financial instruments which may be in the nature of the bond government securities or bank account.

Closing price on 3131986. You can also use 365 instead of 1 to calculate the daily return of an investment. Levered Beta Formula Example 1.

To illustrate the computation of levered beta. It is useful for calculating returns over regular intervals which could include annualized or quarterly returns. In finance the Sharpe ratio also known as the Sharpe index the Sharpe measure and the reward-to-variability ratio measures the performance of an investment such as a security or portfolio compared to a risk-free asset after adjusting for its riskIt is defined as the difference between the returns of the investment and the risk-free return divided by the standard.

PE Ratio is Calculated Using Formula. Return on Equity ROE Total Annualized Return Equity. Now let us take the real-life example below to calculate Coverage Ratios with 2 sets of Different Values of different companies.

The formula for calculating. Annualized HPR Income End of Period Value Initial ValueInitial Value1 1t-1. It is very easy and simple.

2000 1000 1 5 - 1 1487 So the annualized rate of return is in fact 1487. An alternative version of the formula can be used for calculating return over multiple periods from an investment. In finance return is a profit on an investment.

Annualized Total Return. What is PE Ratio Formula. Lets take an example of a portfolio of stocks and bonds where stocks have a 50 weight and bonds have a weight of 50.

Firstly determine the operating profit of the company during the given period of time which is available as a separate line item in the income statement. Jefferson earned the annual interest rate of 481 which is not a bad rate of return. Otherwise the operating profit can be computed by adding back interest expense and taxes.

The formula for the Annualized Rate of Return can be calculated by using the following steps. It is a public listed company and as per available information its unlevered beta of 09 while its total debt and market capitalization stood at 120 million and 380 million respectively as on December 31 2018. Money Multiplier Formula Table of Contents Formula.

Before we apply the formula for the cumulative return we need to make one. Annualized ROI Selling Value Investment Value 1 Number of Years 1. Volatile investments are frequently stated in terms of the simple average rather than the CAGR that you actually get.

What is the Money Multiplier Formula. Apple IncBalance Sheet Explanation. Let us take the example of a company named JKL Inc.

It is calculated as a geometric average to.

Calculate Annualized Returns For Investments In Excel Youtube

Annualized Return On Investment Meaning Calculation Merits Limitations

Return On Investment Roi Definition Equation How To Calculate It

Xirr Annualized Return Formula On Excel Youtube

Rate Of Return Formula Calculator Excel Template

Annual Return Formula How To Calculate Annual Return Example

Calculating Return On Investment Roi In Excel

Annualized Rate Of Return Formula Calculator Example Excel Template

How To Calculate Annualised Rate Of Return A What If Goal Seek Approach Using Excel By Ecyy Medium

Calculate Annualized Returns Using Quarterly Retur Microsoft Power Bi Community

Internal Rate Of Return Irr Formula And Calculator

Annualized Rate Of Return Calculator On Sale 60 Off Lavarockrestaurant Com

How To Calculate Holding Period Return

Dheeraj On Twitter Annualized Rate Of Return Meaning Formula How To Calculate Https T Co Xzjby5luyf Annualizedrateofreturn Https T Co Hkf3udetjm Twitter

Annualized Total Return Assignment Point

Annualized Rate Of Return Formula Calculator Example Excel Template

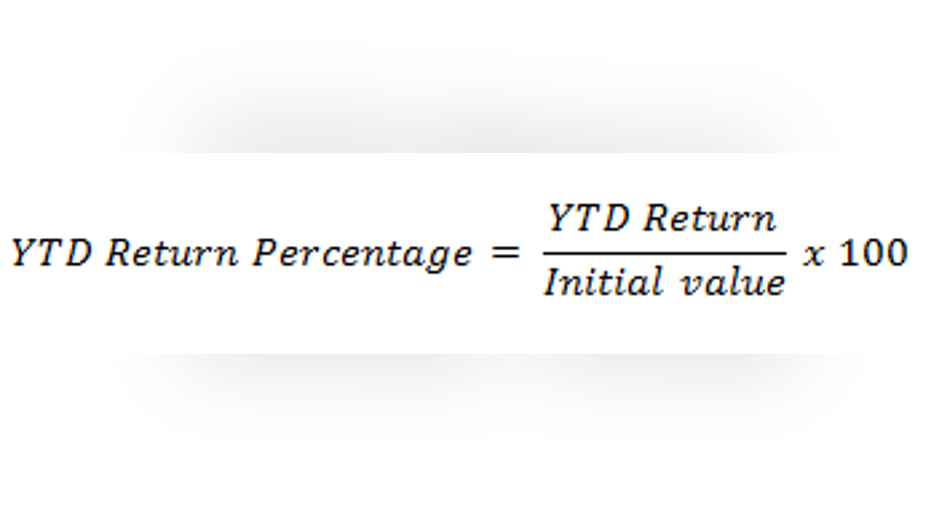

How To Calculate Ytd Annualization Fox Business